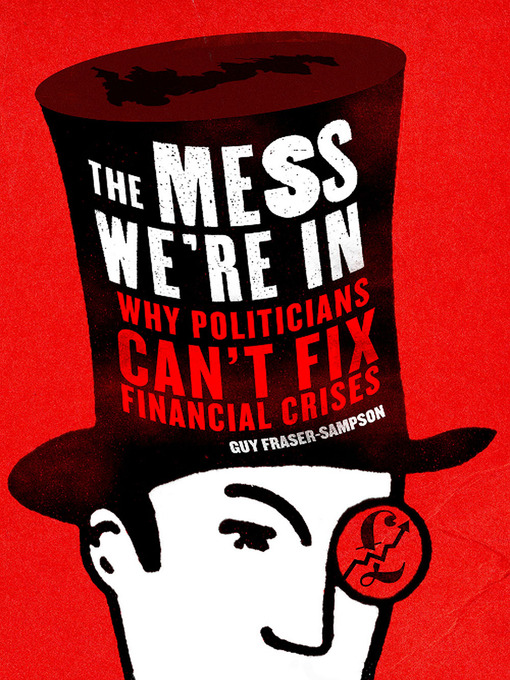

An insightful analysis by the bestselling author Guy Fraser-Sampson of the reasons why politicians have put the world into financial ruin and have found no way out

Around the world, countries are struggling to deal with the aftermath of the 2007–08 banking crisis, hefty budget deficits, the threat of ongoing recession, and the rising costs of pension provision. The news is full of doom and gloom about the ever-growing mess the countries are in. But the real problem is that the very people who should be sorting it out are instead making it worse. In an entertaining mix of historical narrative and conceptual analysis, Guy Fraser-Sampson argues that the present crisis has in fact been several decades in the making, and is the inevitable outcome of years of neglect and betrayal by those trusted to serve and govern over the public. Taking Britain as his test case, he looks back at key economic policy decisions since 1919 to reveal how politicians through the ages have gotten it so badly wrong. In The Mess We're In, Fraser-Sampson sets out the facts to support his claim that, at every opportunity, the political elite has prioritized self-interest over long-term national wellbeing and have caused the current situation; now the time has come for them to be called into account.- Available now

- Most popular

- Always available audiobooks

- All Fiction

- All Nonfiction

- New audiobooks

- See all audiobooks collections

- Battle of the Books - K to 2nd

- Battle of the Books - 3rd to 4th

- Battle of the Books - 5th to 6th

- Battle of the Books - Middle School

- Battle of the Books - High School

- See all featured collections